-

Access Bank has obtained a court order to freeze all crypto trading accounts for investigations.

-

Digital asset fraud is common today, with hackers, scammers, and money laundering utilizing blockchain networks to transfer “dirty” money.

-

In 2021, 0.15% of all known crypto fabrication involved digital asset fraud and money laundering.

The crypto industry has advocated for decentralized money systems, better payment gateways, and alternative means of income for numerous African homes. Its techniques have significantly uplifted several economies and individuals through its growing network. As a result, if unhindered, Africa will eventually dominate the digital asset market. However, the industry could be better.

Despite its revolutionary concept of decentralization, the crypto industry has assisted several actors in money laundering activities. Its anonymous nature has made it nearly impossible to trace the true identity of the parties involved. Thus, its enhanced identity protection has become a haven for money launderers to “clean” money acquired through questionable ways.

This vice is also deeply rooted in Africa’s crypto industry, as billions in crypto coins are lost. In recent news, Access Bank, a Nigerian crypto-friendly bank, had to freeze the accounts of over 500 USDT traders. Of late, digital asset fraud has become an issue. Despite the Nigerian Bank advocating for cryptocurrency, it intends to cut off the source of any money laundering activities.

Access Bank freezes its accounts

Nigeria’s crypto ecosystem leads the continent’s total crypto trading volume, valued only by the remaining Big Four members. When many saw the potential digital assets could have, Nigeria took the initiative to embrace digital payment.

After topping the global crypto trading volume for some time, the region’s government sought to embrace digital assets. They launched Africa’s first CBDC, the e-Naira. Nigeria’s crypto industry has caused a massive impact on digital payment setups as its environment significantly highlights its importance to an economy and individual’s growth. Nigeria is home to Flutterwave, Africa’s top crypto platform, which became unicorn in less than a decade.

Unfortunately, Nigeria has become a haven for money laundering activities because of its lucrative ecosystems. Its plethora of digital payment platforms and its positive initiative to bridge banks and fintech allow perpetrators a wide range of choices. As a result of this rising trend, Access Bank, a Nigerian Bank advocating for digital currency, has frozen 500 USDT accounts.

According to the report, the Nigerian Bank has obtained a court order to freeze all crypto trading accounts for investigations. Digital asset fraud is an everyday activity today, with hackers, scammers, and money laundering utilizing blockchain networks to transfer “dirty” money. Access Bank has claimed that the affected traders had received stolen funds from hackers.

Also, Read Flutterwave management- customer fallout after a US$4 million hack.

It has tied this increased influx of stablecoins to its recent predicaments during May and June. Access Bank reported over $10.4 million in lost funds at the time and needed help tracing the amount. The Nigerian BAnk had to cancel the fund, which was transferred via digital assets further, placing more suspicion in its recent activities.

Unfortunately, this move has received considerable backlash from its Blockchain community. According to Rume Ophi, the executive secretary of the Blockchain Technology Association of Nigeria, the alleged freeing of crypto trader accounts is a disgrace to Nigeria’s banking systems.

Unfortunately, the rapid growth of Nigeria’s crypto industry has had its fair share of opposition. In fact, due to its growing volume, Nigeria’s CBDC needs to improve as its government has turned to undermining tricks and schemes to increase its usage.

Nigeria’s crypto Industry under fire

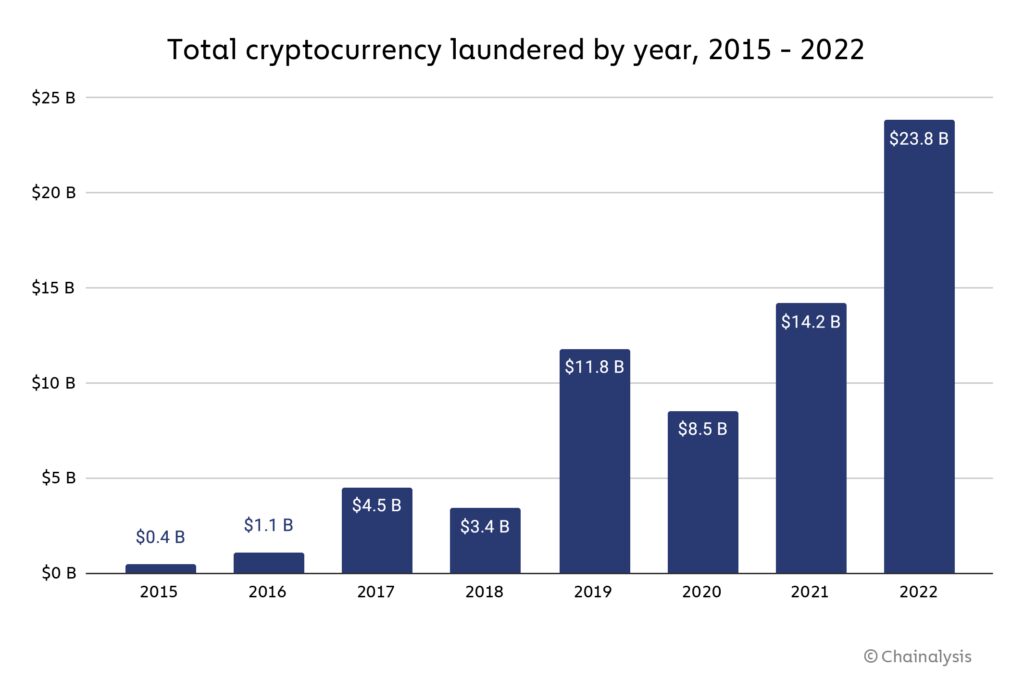

Money laundering and digital asset fraud is an everyday activity in the crypto industry. According to Chainalysis, in 2021, 0.15% of all known crypto fabrication involved digital asset fraud and money laundering. It rustled in a loss of over $14 billion at the time, and its figure has only increased.

In its most recent attempt to control Nigeria’s crypto ecosystem, its government purposely changed its currency but released a significantly lower number. The Nigerian government gave its citizens a small time frame before rejecting its land currency, forcing them to go without. In their ploy, they advised their citizens to turn to their CBDC to access their funding. Unfortunately, this ploy had little response as its citizens turned to stablecoins.

Ophi said, “We need thorough investigations to apprehend the criminals. Instead of resorting to the indiscriminate freezing of accounts belonging to innocent individuals involved in cryptocurrency transactions. This approach isn’t solving the problem; it’s only causing more harm.”

Also, Read Blockchain applications Africans should be excited about.

Access Bank may try to cover up its intentions, but by freezing the crypto trader accounts, it highlights its low trust in digital assets. Unfortunately, we cannot entirely dismiss its fears, as digital asset fraud and money laundering via crypto are standard practices.

To move forward, the government must change its perspective on digital assets. For instance, by adopting the positive outlook from its peer, South Africa, the Nigerian government can find alternative means of taxing its trading volume.

By partnering with crypto exchanges to launch online payment platforms and establish crypto infrastructure, Nigeria’s crypto industry can significantly lift its economy. Unfortunately, navigating the complexities of a crypto legal framework is difficult. Currently, if uninterrupted, South Africa will become the first African nation to develop a legal framework that gives a positive outlook on digital assets.