-

The U.S. election has the crypto community on edge, with potential regulatory shifts influencing Bitcoin prices.

-

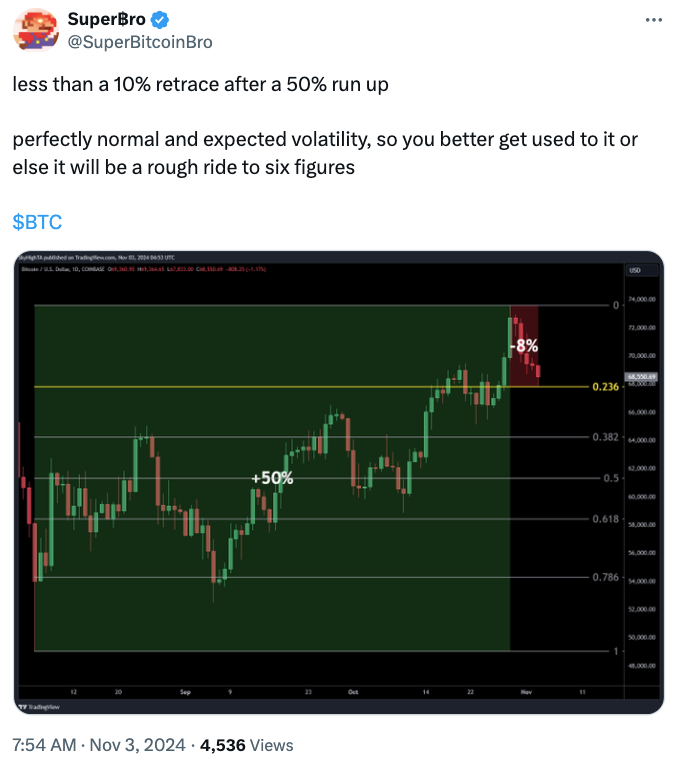

Technical analysis indicates a potential local bottom around $66,200 for Bitcoin.

-

$200 million liquidation in long positions indicates potential pressure on Bitcoin.

As the year draws to an end in only one month and a few weeks, the entire crypto community has its sights set on Bitcoin prices.

The original crypto coin has led its investors and traders through a roller coaster of emotions, highs, and lows. Bitcoin Prices have continued to elude many analysts while rewarding those keen on daily news and other strategic factors.

At the time of writing, Bitcoin is trading at 69,020.45 after shocking the entire community with an all-time high of $73,800. This sudden fluctuation has the community as a whole on edge, as many view this as an opportunity for Bitcoin to potentially reach its $80,000 mark.

Among the recent trends, a noticeable event was the $200 million liquidation in long positions. According to analysts and experts, this may signal the pressure on the original crypto coin and hint at a possible change of tactics to fit this surge.

Analyzing the Impact of U.S. Political Dynamics on Bitcoin Prices

The Web 3 Industry has come a long way since its first application, Bitcoin. Since then, the franchise has expanded to $2.33 trillion with a vast number of coins designed with unique aspects.

Despite the diversity, the crypto community has come to embrace various fundamental aspects that will govern the tides of Bitcoin prices. One of these core concepts is information; like the stock market, the lifeblood of cryptocurrency is information.

Various events affect the markets, and some news may change the tide of digital assets instantaneously. A prime example is the FTX fiasco; in under one month, the Crypto titan was brought to its knees due to the high liquidation rate brought by traders existing.

The impact of various events varies depending on the information provided. Currently, tomorrow’s U.S. election has the entire crypto community on edge. The political tension has significantly increased, especially given that one of the presidential candidates could be the solution to the region’s current “legal” constraints.

According to experts, Bitcoin Prices will experience intense fluctuations, igniting the flames of curiosity amongst new traders. This has resulted in many exploring how the U.S. elections affect Bitcoin prices, but few have advised caution.

Technical Analysis Insights and Current Price Trends for Bitcoin

The current price trend for Bitcoin has thrown off many investors, with some still anticipating severe volatility. The impact of the U.S. election may affect Bictioin prices significantly.

According to trader Titan of Crypto, the original crypto coin may form a local bottom of around $66,200 based on technical analysis indicators. Understanding these tools and analysis methods is vital to plan and anticipate the current price trend for Bitcoin.

Also, Read: How Africa’s Crypto Community Can Benefit from Bitcoin’s $70K Rally.

Various traders have opted to closely monitor critical support levels between $65,000 and $69,000. This range represents a pivotal point for Bitcoin prices. It’s essential for observing vital rebound phases that may affect prices.

Market Sentiment and Strong Interest Amid BTC Liquidation

The BTC liquidation has caused a recent downturn, but it also piqued the interest of many. In addition, the anticipations, rave, and events caused by the Bitcoin Halving Event have spiked interest even more, causing a significant increase in adoptions.

For instance, this event inspired many innovators to launch African-based Token, showcasing the influence such trends have. There is currently significant interest in the future and the vast options crypto traders can explore.

This trend also piqued the interest of several organizations. For instance, QCP Capital admitted to having some interest in the recent market behaviour. The organization pointed out how the implied volatility is significantly exceeding the realized volatility.

This generally added salt to injury, only fanning the flames of fear among traders. Despite current price trends for Bitcoin, it has a checkered past. Within the same year, Bitcoin prices fell below $50,000 but then recovered to approximately $55,000 during a market rebound. In addition to the impact of the U.S. election, many anticipate heavy market fluctuations.

Conclusion

Several factors affect the crypto community, such as information, trust, and performance. These factors often have dire consequences if a trader ignores them. We are Web3Africa, emphasizing caution while transversing these opportunities. Keen insight into economic development and political events would be the stepping stone a trader needs to turn $100 into $10,000.

The intercorrelation between technical analysis and external influences shapes a complex landscape for most traders. This offers both an opportunity and an obstacle for most new traders.

To become a successful trader, one must learn how to access and process new information to formulate new strategies. Understanding how the U.S. election affects Bitcoin prices offers an opportunity for better decision-making.