Crypto ETF/ETP inflows are driving the market to new heights, reflecting how institutional and retail capital is a game changer for the asset space.

In Brief

-

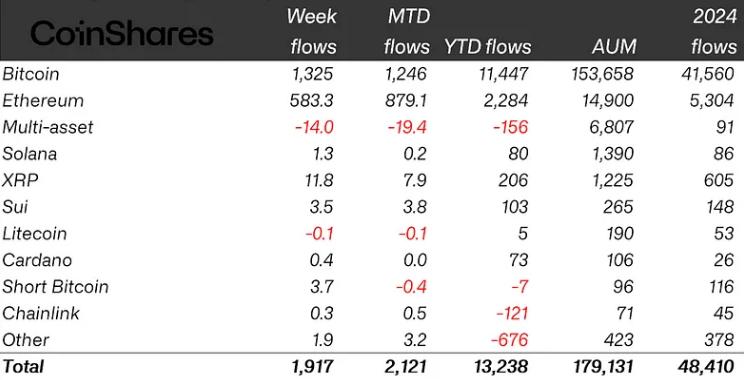

Crypto ETF inflows reached $1.9 B last week, marking the ninth straight week and pushing YTD inflows to a record $13.2 B.

-

Bitcoin led with $1.3 B in weekly ETF inflows near a $106,127 price, while Ether ETPs saw a $583 M surge.

-

BlackRock dominated new inflows with $1.5 B, underscoring strong institutional demand despite geopolitical and macroeconomic uncertainties.

Bitcoin reached new all-time highs, while Ether broke the $2,800 barrier for the first time since February.

Experts have deduced that the US-pro crypto trend recently has fueled newfound confidence within the markets.

According to the latest data from CoinShares, global crypto exchange-traded products (ETPs) attracted a substantial $1.9 billion in new investments by the end of June 13th, 2025.

This marks the ninth consecutive week of inflows, pushing the staggering year-to-date (YTD) total to a historic $13.2 billion.

Total assets under management (AUM) in these products now stand near $179 billion, underscoring the growing mainstream acceptance and scale of crypto investment vehicles.

Institutional Investments Driving the Crypto Market.

Bitcoin has recently dominated news outlets with recent surges in price. The digital assets’ investment program says a robust $1.3 billion flow during this period.

The resurgence highlighted significant Bitcoin investment opportunities as the asset trades near all-time highs, with the current price at $106,127.

Furthermore, short-Bitcoin products recorded modest inflows ($3.7 million) despite their overall AUM remaining relatively low at $96 million, suggesting a prevailing bullish sentiment.

Ethereum wasn’t left behind, with the leading altcoin showing strong momentum.

As per CoinShares Head of Research James Butterfill, this is Ether’s largest weekly inflow since February, with June 11th highlighting their strongest positive inflows($1.9 billion).

Ethereum ETP inflows are a clear example of growing confidence in its underlying technology and approach to building the ecosystem rather than competing with Bitcoin.

Spotlight on Issuer Performance

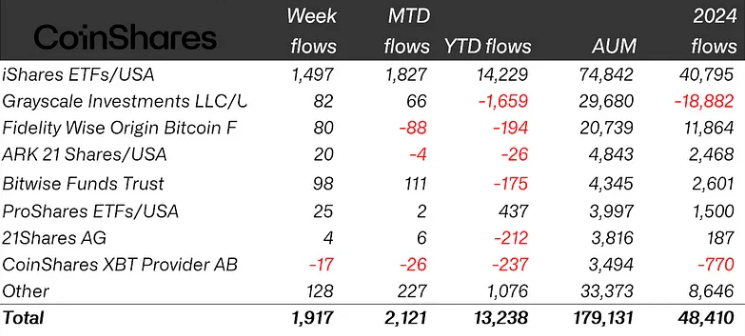

BlackRock continues to dominate the crypto ETF inflows, attracting a massive $1.5 billion in new capital.

The single-week performance pished BlackRock’s YTD inflows past an impressive $14.2 million, solidifying its position as a major gateway for institutional crypto exposure.

Other US-issued crypto ETFs followed, though with considerably smaller weekly inflows (up to $95 million).

Grayscale leads this category with over $1.6 billion flowing out year-to-date.

ProShares stands as a notable exception among US issuers, with year-to-date (YTD) inflows of $437 million.

Market Resilience Amidst Uncertainty

Crypto ETF inflows are particularly striking, given current market uncertainties.

Butterfill pointed out that digital assets displayed some resilience last week despite escalating geopolitical tensions(Israel-Iran Conflict).

Such instances often put assets, such as cryptocurrencies, at risk.

There was a silver lining, with a significant boost in traditional safe-haven assets, as spot gold spiked to $3,448, its highest level since early May, as per TradingView data.

Bitcoin itself wasn’t immune to the initial shock; after nearing $110,000 last Monday, it tumbled to around $103,000 following news of the Israeli offensive on Thursday.

However, demonstrating its own form of resilience, BTC quickly recovered to approximately $106,000 by the week’s end.

CHECK OUT:Is Bitcoin’s Bullish Momentum at Risk? Coinbase Premium Index Shows Seller Pressure

Ethereum similarly weathered volatility, dipping from over $2,800 to under $2,500 before regaining ground.

Analyzing the Broader Picture: Crypto ETF Gains

Looking beyond single-week snapshots, there is greater confidence within the crypto markets.

Cumulative inflows have recorded an all-time high of $13.2 billion YTD figure for overall crypto ETF gains. This paints a positive picture of accelerating institutional adoption and investor confidence.

The Bitcoin ETF performance has been central to this story, rebounding strongly after its brief outflow period. Similarly, Ethereum’s consistent eight-week inflow streak highlights its growing appeal within diversified crypto portfolios.

While a detailed recent crypto fund performance analysis would require deeper historical comparisons, the current CoinShares data unequivocally shows a market experiencing powerful tailwinds.

This trend is clearly captured in their crypto investment funds weekly report.

The clear leadership from giants like BlackRock provides validation and liquidity.

While past performance is never a guarantee, the current trend of significant capital entering via regulated exchange-traded products suggests a foundation for potential continued growth.

For Context

ETPs differ slightly from ETFs.

Typically, an ETP is an umbrella term that describes ETFs, Exchange-Traded Commodities (ETCs), and Exchange-Traded Notes (ETNs).

The difference between crypto ETPs and ETFs is that the former is settled in trades of Bitcoin, while the latter is settled in cash, purchasing Bitcoin with fiat currency.

Additionally, ETFs are regulated, while ETPs are not classified as funds and are more common in Europe.