In Brief

-

Ghana crypto regulations now caution against the use of unlicensed VASPs like Yellow Card and HanyPay, highlighting the BoG’s commitment to formal oversight.

-

A Virtual Asset Providers Act is slated for September, requiring all crypto on/off‑ramps to obtain licenses and comply with AML standards.

-

Upcoming rules—aligned with FATF—aim to foster financial inclusion while protecting users, making compliance essential for sustainable market growth.

Regulation has long been a sore spot for many digital asset providers in Africa and globally.

However, recent developments have suggested that Africa might have a change of heart.

Governments have recently collaborated with regulators and blockchain experts to develop sound rules for virtual assets, but Ghana’s crypto regulations have taken a 180-degree turn on the space.

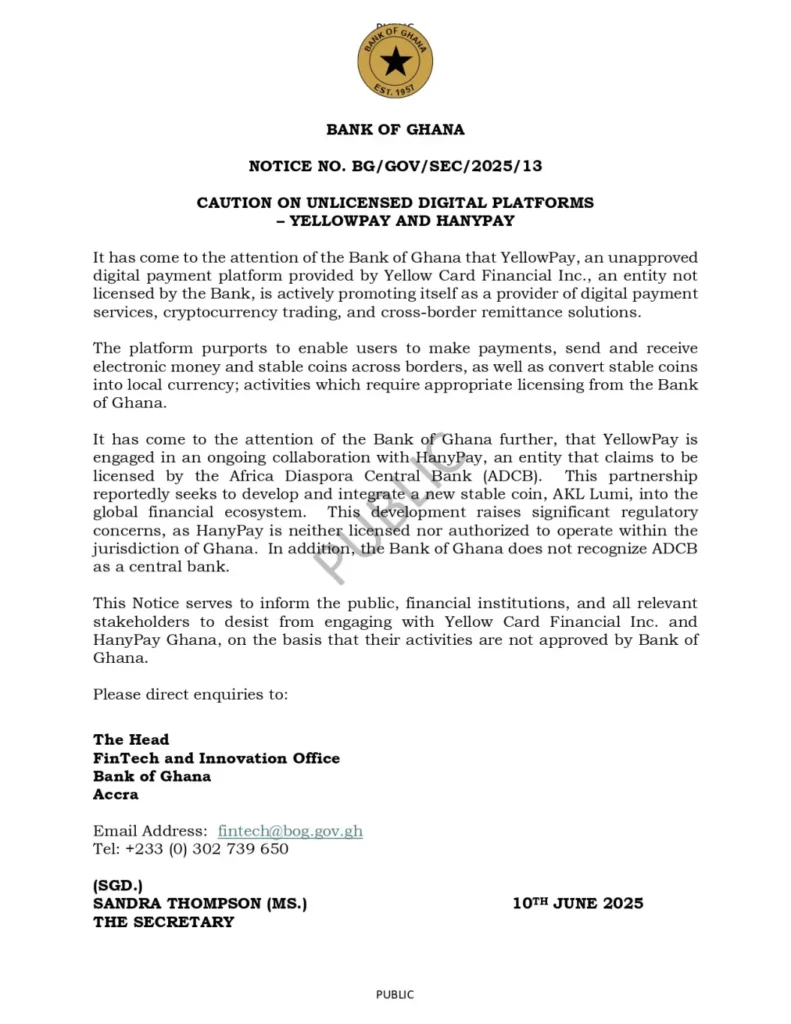

The Bank of Ghana has issued a national warning to the public against dealing with African crypto and stablecoin on/off-ramp, Yellow Card.

This sudden shift has taken a toll on the leading African crypto platforms, forcing them to shut down their services within Ghana.

Ghana Crypto Regulations on The Offensive

Stablecoins have become a growing alternative to many freelancers and businesses within Africa.

The result is pretty straightforward, with digital assets accounting for 43% of all crypto transactions transactions ($54 billion in 2024 alone).

For the ecosystem, this is a major win, but central banks might have a different perspective.

The BoG crypto warning is a prime example, with the central banks calling out Yellow Card as one of the major facilitators of the $54 billion estimate.

The Bank highlighted that the firm has been actively marketing itself as a provider of digital payment services, cryptocurrency trading, and cross-border remittance solutions, all of which require regulatory approval.

Unlicensed crypto platforms have become a major concern for Ghana, particularly as Africa continues to launch new platforms on a yearly basis.

The Bank specifically outed YellowPay, a digital payment platform operated by Yellow Card, which was operating without a license.

The issue also dragged in another entity within the crypto industry: HanyPay, a digital asset platform “supposedly” licensed by the rather mysterious “Africa Diaspora Central Bank.”

What really caught the Bank’s eye was HanyPay’s attempt to provide an all-new stablecoin, AKL Lumi.

The document stated;

“This Notice serves to inform the public, financial institutions and all relevant stakeholders to desist from engaging with Yellow Card Financial Inc. and HanyPay Ghana, on the basis that that their activities are not approved by the Bank of Ghana.“

Here’s the real twist: Yellow Card promptly denied any form of partnership or collaboration with HanyPay, despite the firm having announced the collaboration in February.

The firms described the agreement as a standard API access request, stating that HanyPay had begun onboarding. However, the process was not complete.

Graig Stoehr, Yellow Card’s General Counsel, said:

“It is most unfortunate that the Bank of Ghana determined to publish this notice, as Yellow Card Ghana clearly communicated the above-mentioned facts… well in advance.“

Suspicion grows deeper, raising questions on the legitimacy of HanyPay.

“This development raises significant regulatory concerns, as HanyPay is neither licensed nor authorized to operate within the jurisdiction of Ghana. In addition, the Bank of Ghana does not recognize ADCB as a central bank,” the statement added.

Ghana’s crypto regulations are still in their nascent stage, but with recent developments across all African corners, the Central bank have actively made preparations.

HanyPay has yet to make any public response. However, the issue showcases the growing dilemma many African crypto platforms face.

The exact Yellowpay license status in Ghana remains a central point of contention between the company and the regulator.

Vigilance over Quick Adoption: Ghana’s New Take

Digital asset rules in Ghana have evolved over the years, and this case highlights the region’s commitment to the matter.

As of May 2025, the BoG publicly announced its plans to develop a formal Virtual Asset Providers Act by September.

This new policy will allow the BoG oversight authority over VASPS, requiring them to obtain a licence.

Governor Johnson Asiami spoke at the African Leaders and Partners Forum during the IMF-World Bank Spring Meetings in Washington, stating that the BoG is committed to fostering digital asset adoption.

The unlicensed stablecoin alert exemplifies this statement; however, remittance compliance challenges still persist.

The clear warning against Yellow Pay and HanyPay is a clear blow to both firms, but it speaks volumes to the kind of vigilance the BoG is fostering.

In 2024, the BoG released draft regulations for cryptocurrencies, with the primary aim of fostering financial inclusion while ensuring economic stability and protecting users, first and foremost, against risks such as money laundering.

CHECK OUT:Ghana Moves to Regulate Crypto Market: BoG Announces New Draft Guidelines for Exchanges

The BoG intends to align its regulation with FAFT recommendations, while also considering the broader use cases for digital assets, such as tokenization.

African blockchain startups have experienced significant growth over the years. Yellow Card serves a good number of regions, including Kenya, Zambia, Rwanda, and Morocco.

Its success heavily influenced the surge of stablecoin adoption in Africa, giving other startups the momentum they need to grow.

In this specific case, vigilance is emphasised over adoption. Staying compliant with regulations is a clear way to foster adoption in a manner that benefits the economy as a whole.

As for HanyPay, the silence speaks volumes.

As Ghana finalizes its ghana crypto regulations, adherence to the BoG’s directives and a commitment to compliance from all stakeholders will be fundamental to building a trustworthy and sustainable digital asset ecosystem.