In Brief

-

Crypto payments in South Africa are shifting from speculation to daily utility, with over 31,000 merchants accepting digital assets.

-

Stablecoins like USDC/USDT drive secure, fast transactions, making crypto payments ideal for both local spending and cross-border transfers.

-

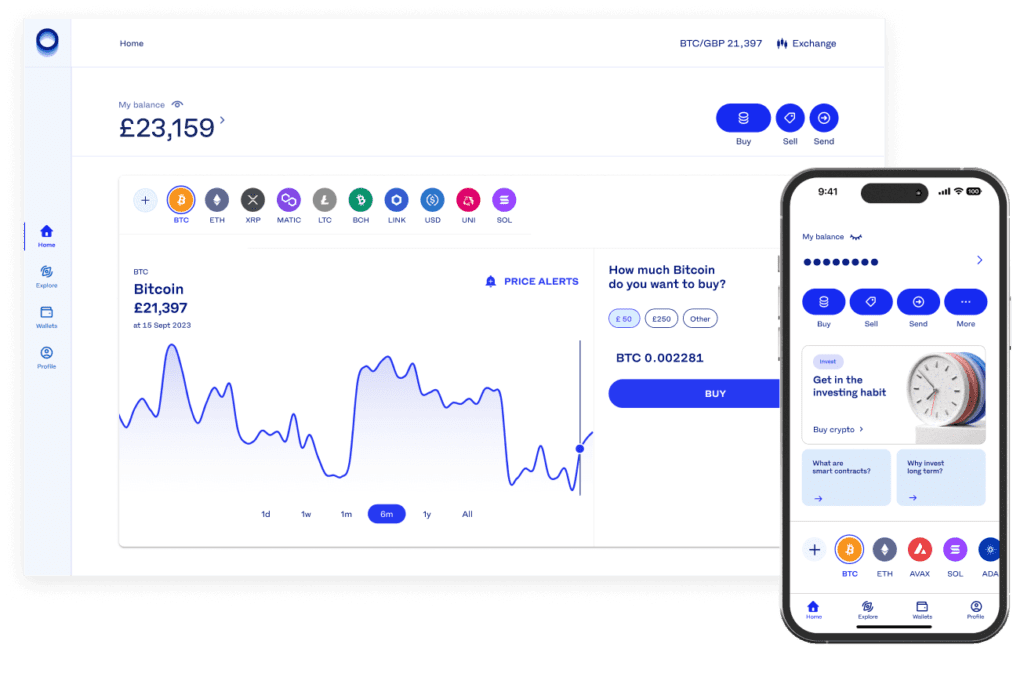

Platforms like Luno Pay are building the infrastructure that integrates crypto payments into mainstream commerce, signaling long-term adoption.

For years, the conversation around cryptocurrency centred around its volatility, its potential to become a digital gold or a digital nightmare, and, most importantly, its ability to redefine cryptocurrency.

South Africa, one of Africa’s leading crypto ecosystems, best known for its proactive regulatory system on crypto payments, is taking the bold step in showcasing why Africa can lead.

A recent study from Luno, a trailblazing exchange powering Africa’s crypto ecosystems, revealed that South Africa spends over $112,000(R2 million) each money for daily activities.

Without wasting any further time, let’s dive in and see how South Africa is showcasing how cryptocurrency is here to change the narrative.

The South African Crypto Payments Surge:

Digital assets in South Africa have developed significantly over the years.

The region is among the first African nations to launch a crypto regulatory framework focused mainly on creating a positive environment for digital assets.

Luno, an African exchange deeply rooted in South Africa’s crypto community, recently revealed that since the launch of Luno Pay, a dedicated retail payment tool, South Africans have redefined how to use crypto.

Normally, users often hold their crypto tokens in the hope of a bull run to increase their value.

Unfortunately, this isn’t the case in Africa. Since November 2024, Luno Pay has recorded over $1.1 million (R20 million) worth of crypto transactions.

The sheer efficiency, low cost, and yield potential cryptocurrency holds have developed an entire generation who actively use crypto.

The findings revealed that South Africans have discovered how to spend crypto daily to buy groceries, book flights, furnish homes, and access various services.

Christo de Wit, South Africa Country Manager at Luno, underscores this transformation:

“The appetite for digital currency transactions in everyday commerce is growing. Our data shows that many customers use Luno Pay regularly for routine purchases and services.”

This statement captures a fundamental change in perception and behaviour: crypto in South Africa is no longer just about trading or holding but an active alternative to fiat currencies.

South Africa has the continent’s largest crypto infrastructure, with OTCs and even crypto ATMs available throughout numerous population points.

This existing user base is now actively exploring the practical applications of their digital assets in South Africa.

The Rise of Stablecoins and Retail Networks: Where South Africans Pay with Crypto

One of the main enablers of this digital shift is the high reliance on stablecoins.

From its name, these digital assets offer a more suitable alternative for everyday transactions.

Stablecoin transactions have formed the bedrock for most cross-border transactions and payments. Businesses, freelancers, and even traders have opted for USDT or USDT due to its value retention.

Research revealed in 2024, the total value settled via stablecoins reached a staggering $27.6 trillion. This figure exceeded the combined transaction volume processed by Visa and Mastercard.

Given South Africa’s pro-crypto trend, merchants and retailers have grown more accustomed to stablecoins. Luno reported that a remarkable 31,000 merchants across South Africa now welcome crypto payments.

Luno has played a major role in ensuring crypto goes beyond just trading, and its Pick nPay, a supermarket chain, has emerged as its largest partner.

South Africans can now routinely use crypto to buy weekly groceries, contributing to the development of the region’s crypto ecosystem.

Additionally, with partnerships like Zapper, Luno Pay enables users to spend their crypto at major retailers, including Dis-Chem, Hirsch’s, Dial-a-Bed, One Day Only, and more.

This also includes online platforms One Day Only, Loot, and YuppieChef.

Fancy a meal out? Spur restaurants accept crypto payments.

Need to book a flight? FlySafair enables bookings using digital currencies. The avenues for how to spend crypto daily are multiplying rapidly.

User Behavior: The Shift from Experimentation to Habit

Crypto payments in Africa have become more mainstream, with South Africa leading the charge.

As per Luno’s analysis, 80% of Luno Pay users are repeat customers, transacting every week.

CHECK OUT:Comply or Cry: Binance’s New Rules Shake Up South African Crypto

The level of consistent usage showcases that cryptocurrency adoption in Africa has moved from initial curiosity or one-off experiments to users finding tangible value and convenience in crypto for regular purchases.

The loyalty suggests that users are steadily opting to pay with crypto retailers embedding themselves as a genuine and reliable alternative to traditional payment rails.

Additionally, Visa and Mastercard have shifted to incorporate crypto payments, further proving why digital asses are more than just trades.

It’s addressing a real need, whether that’s a faster settlement, lower fees (especially for cross-border), access for the underbanked, or simply the appeal of using a novel, digital-native asset.

As Christo de Wit stated,

“We’re building the infrastructure for a future where cryptocurrency seamlessly integrates with traditional commerce. People want choice, and crypto offers that.”

While trading and investment will always be part of its DNA, cryptocurrency was initially created as an alternative means of finances.

Satoshi Nakamoto created Bitcoin not for individuals to horde or store but to replace financial systems.

Digital assets in South Africa exemplify this belief, with more users opting for crypto payments for their efficiency and low cost.

This goes beyond pure speculation and now is a tangible alternative for many South Africans.

The era of spending crypto daily has demonstrably arrived.