-

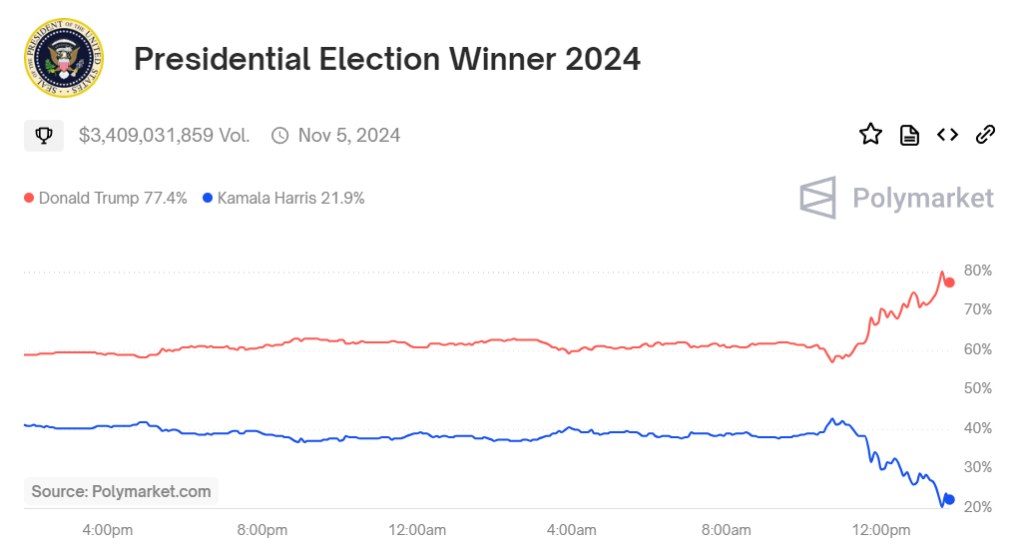

Donald Trump leads in elections, causing a surge in Bitcoin prices.

-

A recent Bitcoin rally saw an intraday high of $70,577 before reaching $75,000.

-

Market volatility is heavily influenced by U.S. electoral events, with future surges anticipated.

Cryptocurrency has reached a new time, with Bitcoin prices reaching an all-time high of $75,000. The events of the U.S. elections have sent the entire community into a frenzy, with Donald Trump currently holding the lead.

The original cryptocurrency lived up to its name and showcased how loyal its community is as it surged immediately after Trump’s lead was announced.

As per the analysis of our previous article, U.S. elections alone have drastically affected market volatility, yet analysts still suggest there are more surges to expect.

The Impact of U.S. Election Results on Bitcoin Prices

The entire crypto franchise has experienced a drastic turn of events as Bitcoin finally achieves the $75000 mark. This recent surge is primarily affected by early electrol results favouring Trump.

In an almost instantaneous manner, crypto traders all over aligned in support as Bitcoin transactions increased in about an hour. This significant peak is only topped by its previous high of $73,800 recorded in March.

As per CoinMarket, Bitcoin rallied more than 3%, hitting an intraday high of $ $70,577 before continuing its momentum. In addition, as recorded at 3:08 AM UTC (06:00 AM EAT) on November 6, Bitcoin peaked at $75,000.85 on Coinbase, showcasing that traders are keenly observing the U.S. elections.

Also, Read Bitcoin on the Rise: U.S. Politics and Fed Cuts Set Stage for Major Price Moves.

This showcases a more profound understanding among many traders and the community at large. Bitcoin essentially could replace a century-old system; this comes as no easy feat. This also serves as a clear indication of how the political landscape can affect market volatility.

Correlation Between U.S. Election Outcomes and Bitcoin Prices

As per the Bitcoin price reading, it’s evident that there is a strong correlation between the U.S. election outcomes and fluctuations in Bitcoin price. Trump has openly advocated for cryptocurrency and has promised to take on the SEC in regard to its “crypto hunt.”

On numerous occasions, he has clearly indicated that Bitcoin is the future of finance, but it’ll benefit those who take advantage of it first. Trump’s rising electoral odds are fueling a bullish sentiment and showcasing how unity can drive the ecosystem.

Impact of Electoral College Votes

As per the initial announcements, Trump is leading this political race by 198 electoral cols; lege votes compared to Kamala Harris, who only attained 112. This steady winning streak has the entire community on edge but optimistic about their odds. The impact of election results on Bitcoin price is a fact by now.

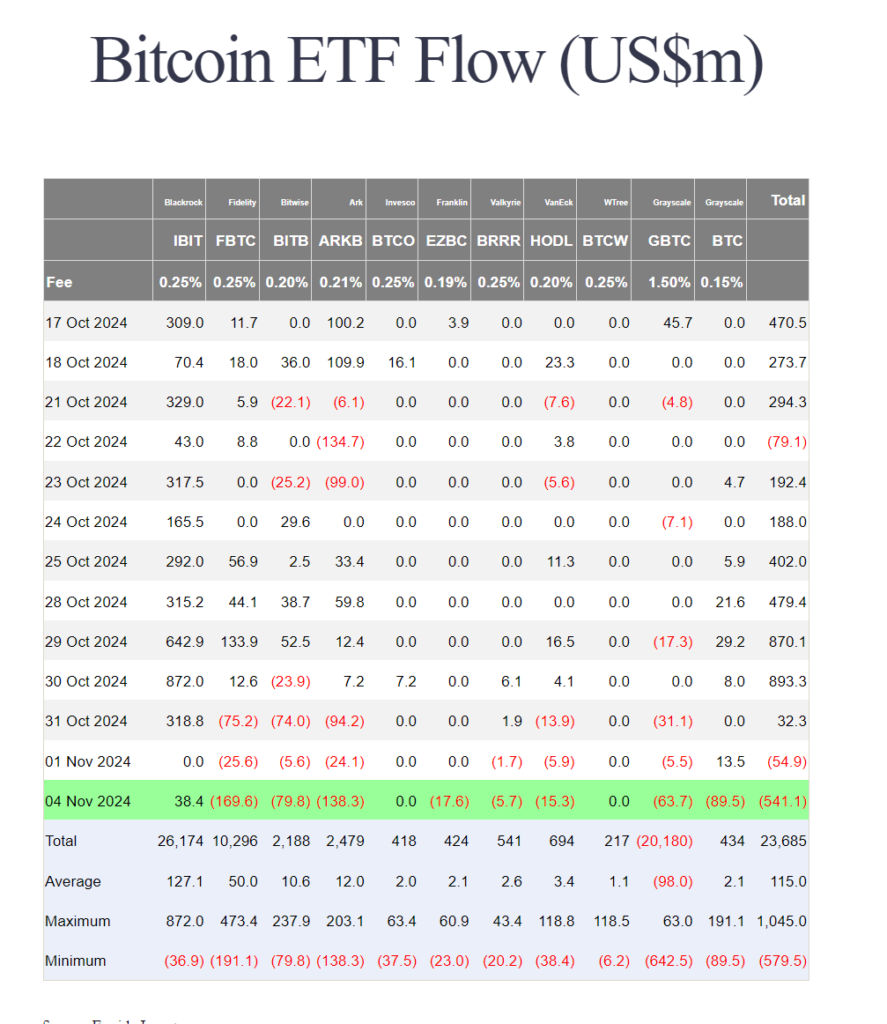

However, some still caution the community to beware of market volatility. Bitcoin has had its ups and downs; for instance, on November 4 alone, the industry experienced significant outfol=lows from Bitcoin ETFs totalling $541.1 million. This also comes as a sign that investors are playing it wise this time around.

Forecasts from Industry Experts

Industry analysts remain optimistic about Bitcoin’s trajectory post-election. For instance, Standard Chartered analysts speculate that if Trump secures the presidency again, we could see Bitcoin rise to approximately $76,000 shortly after the election concludes.

Furthermore, there is even speculation suggesting it could reach as high as $125,000 by year-end should Republicans gain control over both Congress and the presidency.

As we delve deeper into this period marked by heightened activity around U.S. elections, it becomes evident through analysis of Bitcoin trading that traders are increasingly focusing on these political events as critical drivers for price movements.

With such direct correlations drawn between election outcomes and shifts in investor sentiment toward cryptocurrencies like Bitcoin, the price will likely reflect these dynamics closely.

Strategies Amidst Market Volatility

In light of anticipated market volatility following the elections’ impact on cryptocurrency prices, traders may adopt various strategies tailored to navigate through these expected fluctuations effectively:

1. Hedging: Many may choose to hedge their positions using derivatives or options contracts explicitly designed to protect against adverse moves.

2. Trend Following: Others might opt for trend-following strategies based on technical indicators signalling bullish or bearish trends linked with election-related news.

3. Diversification: Lastly, diversifying portfolios across multiple cryptocurrencies could provide a buffer against sudden swings tied directly to external factors like election results.

Wrapping Up

As we analyze how unfolding U.S. elections correlate with current market dynamics influencing Bitcoin price volatility, it remains inevitable yet promising under favourable political landscapes for cryptocurrencies like BTC itself.

In summary, while uncertainty looms large amidst shifting electoral landscapes affecting investor sentiments across various asset classes, including cryptos—the overall outlook remains cautiously optimistic given historical precedents set forth during times when politics interlace intricately with economic realities shaping our world today!