- In 2022, the unbanked Fintech attracted nearly $1.5 million from 1500+ investors due to its zeal for the trade.

- The Unbanked Fintech had expected $5 million in funding, but due to the ripple effects of crypto regulators intervening with the ecosystem, it did not materialize.

As the crypto ecosystem steadily improves, various exchanges face tough times due to crypto regulations. Decentralized finance and crypto have advocated for increasing final inclusion throughout the globe. However, since the FTX, it became clear that any exchange has the potential to become a crypto scam. Due to this fact, regulators have targeted esteemed crypto exchanges in hopes of discovering any hint of irregularity.

Unfortunately, due to the harsh crackdown on the crypto exchanges, it may be a farce to control the very nature of the market steadily. In recent news, Unbanked Fintech, a crypto fintech firm, is another crossed-out name among those who have succumbed to lawsuits against their operations.

With the Unbanked Fintech closed, the dream of global financial inclusion dims. Is the crackdown truly the way to improve and secure the ecosystem?

The vision of the Unbanked Fintech

The concept of decentralized finance was a by-product of the initial Bitcoin blockchain network. Bitcoin gained immense popularity at its creation as users found its easy-to-use mechanism and non-restrictive procedure far more appealing than traditional banking systems.

Soon developers found to construct better and more efficient financial stems based on blockchain’s fundamental technology. Soon t became possible generally attain banking privileges without necessarily signing up with a bank. Thus the concept of banking the unbanked came to be, and it took the entire ecosystem by storm.

Also, Read Africa: Redefining financial inclusion through decentralized finance (DeFi).

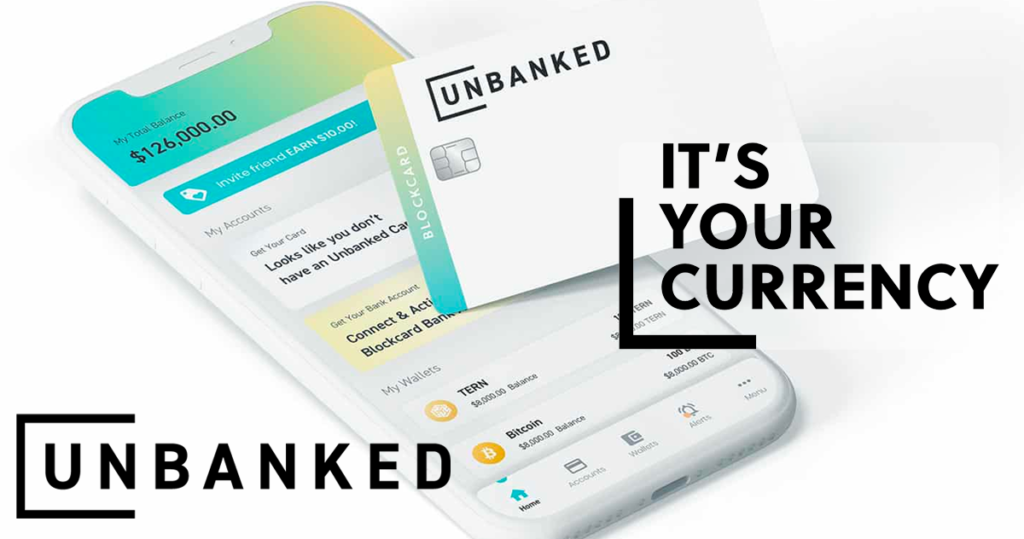

In 2022, the unbanked Fintech attracted nearly $1.5 million from 1500+ investors due to its zeal for the trade. Unbanked Fintech offers an app-based bank account with a debit card. Their firm belief in decentralized fiance led both founders to design a system that merged old and new financial concepts.

Essentially the crypto fintech firm offered traditional banking services like holding cash and debit cards but enabled users to buy, sell and withdraw crypto. Furthermore, their debits card were directly linked to the user’s crypto account, providing digital currency with direct purchasing power.

According to Kane, Unbanked Fintech had ambitious goals that would profoundly change the world’s view on finning. He said, “Our long-term vision is more competitive with Revolut or Coinbase but with a business-to-business (B2B) focus. This enables other companies to offer crypto-friendly fintech offerings to their customers, including cards and bank accounts.“

Initially, when it started, the crypto fintech registered with crypto regulators such as SEC and FinCEN in the US. Unfortunately, they would later regret this decision since the same regulars who approved its operation were those who shut it down. The unclear crypto laws of such regulators provided a loophole cutting their dream short.

Unbanked Fintech was betrayed by its regulators.

On May 2023, Unbanked Fintech declared its imminent closure. In a statement, they said that the harsh crypto laws and regulatory environments within the US had provided no alternative to closing shops and ending their long run.

After five years of operating, Ian and Daniel have revealed that their decision to open a shop in the US was their undoing.

The crypt fintech firm took an alternative approach as many of its peers opted to avoid the vague crypto laws of the US. They genuinely believed starting from home to establish change is often best. However, the founder soon discovered that the US crypto regulators were deliberately hindering banks and fintech companies from supporting crypto assets.

Also, Read The decentralized vision: Ethereum Advocates for Zero-Knowledge Technology.

This is a shock since Unbanked Fintech has complied with established crypto laws since its founding. The sudden closure has caused a ripple effect throughout the market due to its unexpected nature. The crypto fintech firm had recently achieved several milestones and acquired various crypto partnerships with key figureheads such as Mastercard.

Unrotuanley, the Unbanked Fintech had expected $5 million in funding, but due to the ripple effects of crypto regulators intervening with the ecosystem, it did not materialize. The founders have attributed this setback to the recent crackdown on exchange despite unclear and vague crypto laws established within the US.

This has created a harsh work environment for Unbanked Fintech, hindering its operation and any attempt to raise capital. The company had disclosed a signed term for $5 million investments three weeks prior with a valuation of $20 million.

This deal would have significantly propelled Unbanked Fintech’s operations, eventually leading to an expected expansion. Since they could not complete the transaction, Unbanked Fintech chose to close its curtains rather than deceive its users.

The crypto fintech firm has officially advised its customers to withdraw their assets immediately. It has provided a 30-day withdrawal window and strongly urges customers to initiate the process immediately.

Conclusion

With crypto regulators still tightening their grip on the market, this recent outcome proves it all. The US has become a hazardous environment for any decentralized finance to thrive. Binance, Kraken and Coinbase have all sought alternative ground, and Africa appears to be the more viable solution.

Also, Read Africa-focused crypto firm, Paxful is finally closing shop.

Crypto laws are set in place to ensure the proper integration of digital currency within a government. It prevents fraud and theft while benefiting both the user and the government. Without this set principle, it serves only as a leash to keep the concept of decentralized finance at bay. The Unbanked fintech company closing up serves as a reminder that regulators need to take a better approach when setting laws on digital currency.