-

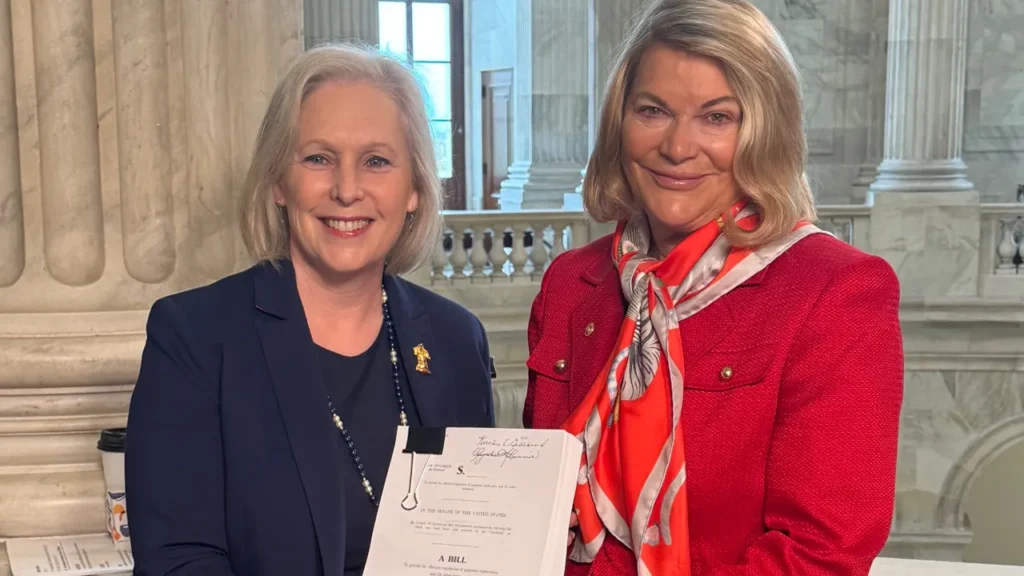

U.S. Senators Kirsten Gillibrand and Cynthia Lummis introduced the bipartisan Lummis-Gillibrand Payment Stablecoin Act to improve stablecoin regulation.

-

Regulatory compliance, financial stability, and third-party risk management are prioritised to mitigate systemic risks in the cryptocurrency market.

-

The bill mandates one-to-one reserves for stablecoin issuers and prohibits unbacked, algorithmic stablecoins from safeguarding consumers and the dominance of the U.S. dollar.

U.S. Senators Kirsten Gillibrand and Cynthia Lummis have introduced the bipartisan Lummis-Gillibrand Payment Stablecoin Act, a significant development for the cryptocurrency industry.

This landmark legislation aims to create a robust regulatory framework for payment stablecoins, addressing critical consumer protection, innovation, and financial integrity concerns.

The Lummis-Gillibrand Payment Stablecoin Act

At the core of the proposed bill are stringent regulatory mandates designed to safeguard consumers and maintain the dominance of the U.S. dollar.

The legislation mandates one-to-one reserves for stablecoin issuers, ensuring that reserves fully back stablecoins. Additionally, the bill prohibits the issuance of unbacked, algorithmic stablecoins, mitigating the risks associated with speculative tokens.

Crucially, the regulatory oversight outlined in the bill involves a collaborative effort between state and federal regulators. This inclusive approach underscores the importance of collaboration in ensuring effective oversight of stablecoin operations, reflecting a concerted effort to balance regulatory clarity and innovation within cryptocurrency.

The Lummis-Gillibrand Payment Stablecoin Act also seeks to empower financial institutions by providing clear guidelines for stablecoin issuance.

State non-depository trust companies are granted the authority to issue payment stablecoins up to $10 billion, while limited-purpose state or OCC depository institutions have the flexibility to issue stablecoins without predefined limits.

This provision aims to foster innovation while maintaining regulatory oversight over stablecoin issuance, instilling hope in the audience.

Collaborative Regulation: CBN and SEC’s Approach to Crypto Oversight in Nigeria

The introduction of this bill comes amidst growing concerns from lawmakers and industry stakeholders regarding the regulation of stablecoins in the United States.

The Lummis-Gillibrand Payment Stablecoin Act represents a proactive step towards addressing these concerns by imposing strict regulatory requirements and fostering collaboration between regulators and industry participants.

Furthermore, the bill incorporates feedback and technical assistance from key stakeholders, including the Federal Reserve, the Department of the Treasury, and state regulatory bodies. This collaborative approach ensures that the regulatory framework is well-informed and responsive to the evolving needs of the cryptocurrency market.

In addition to consumer protection and innovation, the Lummis-Gillibrand Payment Stablecoin Act prioritises regulatory compliance as a cornerstone of stablecoin governance.

The legislation aims to enhance financial stability and mitigate systemic risks within the cryptocurrency market by mandating one-to-one reserves and prohibiting unbacked, algorithmic stablecoins, providing a sense of security to the audience.

The inclusion of rigorous third-party risk management measures underscores the importance of safeguarding against potential vulnerabilities in stablecoin issuance and custody practices.

The bill seeks to bolster the resilience of the stablecoin ecosystem against external threats by imposing strict compliance requirements on service providers and excluding self-hosted wallets from certain activities.

Furthermore, the involvement of key regulatory agencies, including the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), underscores the commitment to comprehensive oversight and enforcement.

This multi-agency approach ensures that issuers follow strict anti-money laundering (AML) and sanctions regulations, reflecting a concerted effort to address the intricate regulatory challenges of stablecoin operations.

As the recent FTX incident has shown, robust custody procedures and regulatory oversight are essential for mitigating potential risks.

By incorporating lessons learned from past incidents and leveraging insights from regulatory bodies and industry experts, the Lummis-Gillibrand Payment Stablecoin Act aims to strengthen the resilience of the stablecoin market and bolster investor confidence.

Moreover, the bill’s emphasis on collaboration with state regulatory authorities, such as the New York Department of Financial Services and the Wyoming Division of Banking, reflects a commitment to fostering innovation while maintaining regulatory integrity.

The legislation seeks to create a harmonised regulatory framework that promotes innovation and safeguards against financial misconduct by leveraging the expertise of state regulators and facilitating cooperation between federal and state agencies.

In conclusion, the Lummis-Gillibrand Payment Stablecoin Act represents a significant milestone in the ongoing efforts to establish a comprehensive regulatory framework for stablecoins in the United States.

The legislation prioritises consumer protection, innovation, and regulatory compliance, laying the foundation for a more transparent, resilient, and inclusive financial ecosystem. As policymakers continue to refine and implement regulatory measures, the cryptocurrency industry stands poised to benefit from greater clarity, accountability, and stability in the coming years.

Regulatory clarity and consumer protection remain paramount as the cryptocurrency industry evolves.

The introduction of the Lummis-Gillibrand Payment Stablecoin Act marks a significant milestone in establishing a comprehensive regulatory framework for stablecoins in the United States. By promoting transparency, accountability, and innovation, this legislation sets the stage for a more resilient and inclusive financial ecosystem.

Read: Binance’s Crypto Literacy Quest: Journeying Through Bitcoin NFTs and USDT

The bipartisan effort to introduce the Lummis-Gillibrand Payment Stablecoin Act underscores lawmakers’ commitment to addressing the regulatory challenges posed by stablecoins’ rapid growth.

By working to establish clear guidelines and oversight mechanisms, policymakers aim to foster a safe and vibrant environment for innovation in the cryptocurrency space.