- Africa’s financial inclusion has increased from 23% in 2011 to 43% by 2022.

- In 2022, 36% of startups in Nigeria are fintech ventures representing almost three times more than any other sector.

- South Africa has 225 fintech startups representing 45.9% of its total tech ventures in 2022.

Africa’s web3 industry has given rise to numerous innovations over the past few decades. Innovators have pushed its limit, from establishing companies incorporating blockchain technology in real estate to launching a decentralized hospital database. In addition, the adoption of digital money has steadily grown, and the concept will soon be widespread throughout the continent. However, one such application stands above all else in terms of growth rate and success, Africa’s fintech Industry. The concept of decentralized finance has led to the growth of multiple startups in Africa, each promising fame and fortune. With this industry, three key players have taken the title of Africa’s fintech hubs.

South Africa, Nigeria and Kenya have stood at the top due to the innumerable fintech startups that have revolutionized the continent’s financial system. This article will highlight why these three countries might use the “next big thing” in the global financial service system.

The success behind Africa’s fintech hubs

Over two decades ago, Africa missed several revolutionary points globally. Its technological advancements significantly paled compared to other continents, and many assumed that Africa and technology were like water and oil. Fortunately, as blockchain technology emerged, so did Africa’s web3 industry. Soon Africa’s slow pace in adopting new technology was the reason for its high aptitude for web3.

The concept of Bitcoin and digital money took the continent by wave, leading to the highest adoption rate. Decentralized finance soon became the very technology that would assist in progressing Africa’s digital transformation and aid its economy overall.

According to the International Finance Corporation, Africa’s financial inclusion has increased from 23% in 2011 to 43% by 2022. In under a decade, due to the efforts of Africa’s fintech Industry, its financial inclusion has doubled, setting the pace for additional improvements.

Also, Read Binance launches a crypto education hub in Cameroon.

Alongside the rapid adoption of digital money, other industries steadily grew. During the Covid crisis, Africa’s digital economy exponentially increased despite setting back other sectors, and E-commerce soon became the salvaging point for most businesses thriving today. In addition, Africa’s web3 industry also grew as more individuals sought alternative means of income generation.

According to Caroline Freund, former World Bank Global Director for Finance, Competitiveness and Innovation, Covid was the turning point that Africa’s fintech required to break through. She stated that the fintech industry has rapidly adapted to the pandemic and offered insight for regulations and policymakers seeking to promote innovation.

In addition, she claimed that Africa’s fintech Industry grew by 40%, positively affecting both its digital economy and its Mobile Industry. This set Africa’s path to digital transformation in stone, and its fintech industry would show it.

The big three African fintech Hubs

Despite the rapid growth of Africa’s web3 industry, its growth rate mainly has a few countries to thank. South Africa, Nigeria and Kenya are among the top competitors, each striving t dominate the continent’s Web3 ecosystems. For instance, South Africa and Nigeria have embraced the concept of digital money, having one of the highest trading volumes accompanied by comovement support.

Kenya is renowned as East Africa’s tech hub and for good measure. IT was among the first in Africa to develop a variation of digital money that paved the way for its rapid adoption rate. Here is a deeper look at why these three countries are renowned as Africa’s tech Hub

Nigeria

Nigeria, also known as the continent’s self-proclaimed crypto hub, has dominated the fintech industry for some time now. It has developed some of Africa’s most outstanding and unique blockchain-based sectors in the last decade. Having 150 to 200 fintech startups, Nigeria has proven capable of leading Africa’s web3 industry.

Also, Read Digital KYC system’s ability to revolutionize the African Fintech Industry.

Due to the support of its governments from the get-go, Nigeria has nurtured several promising ventures that have left the entire globe in shock. It is home to five of Africa’s unicorn startups, dominating the fintech industry and digital economy.

As one of Africa’s fintech hubs, Nigeria is home to Flutterwave fintech, a leading fintech company within the industry with an evaluation of $1 billion. In 2022, 36% of startups in Nigeria are fintech ventures representing almost three times more than any other sector. It is also the country’s largest market having a total transaction value of $58.37 million, according to Statista.

The country’s fintech industry proves decentralized finance can uplift Afrca’s economy. According to the National Financial Inclusion, Strategy, Nigeria had a target of 70^% financial inclusion by 2020, and despite not achieving its steady growth has significantly closed the gap to its goal. Aside from Flutterwave, Nigeria is also home to Interswitch, Jumisa, Opay and Andela.

South Africa

South Africa is one of the unique ecosystems within Africa’s web3 industry. It was one of the few countries in the world to initially embrace the concept of digital money when most of its peers shunned it without a second thought. Its acceptance of crypto coins and blockchain applications has set it aside for every other African nation.

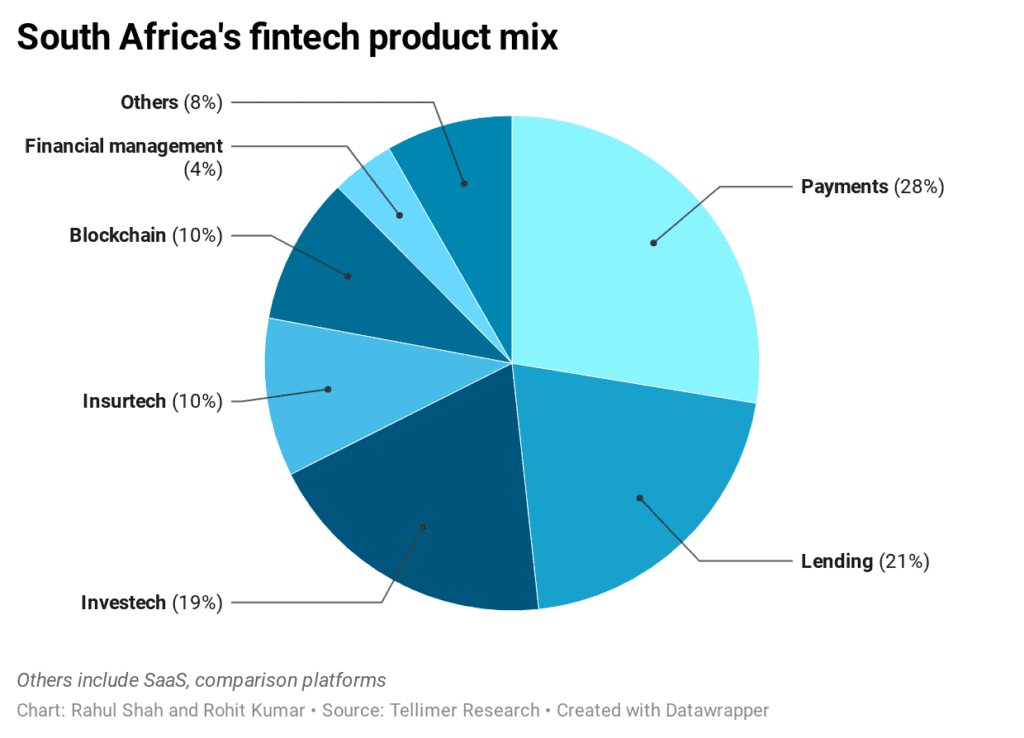

Its fintech industry is also a product of its willingness to adapt to the technological transformation the content is undergoing. South Africa has unevenly spread the fintech industry in two significant towns; Cape Town and Johannesburg. It has 225 fintech startups representing 45.9% of its total tech ventures in 2022. the ts ecosystem is considered a melting point for any African fintech industry. It huses sevral finacial instiutions such as Standard Bank Group, FirstRand, Absa Group, Nedbank Group, and Investec.

In doing so, it will maintain confidentiality requirements for real-time gross settlement on Enterprise Ethereum. Cape Town, SA’s second-largest city, provided 75% of the nation’s venture capital. With this figure, 15% goes within its fintech Industry.

In addition, it also contains one of the oldest incubators in Africa, The Cape Innovation and Technology Initiative (CiTi). This organization has aided countless innovators within Africa’s web3 industry. Its government has ensured that most, if not all, its laws are fintech friendly, setting the stage for improvement.

Kenya

Kenya started its journey as one of Africa’s fintech hubs long before anyone perceived the meaning of decentralized finance. The establishment of the Mpesa ushered in the first age of digital money. Its rapid growth paved the way for numerous developments and is also the main reason crypto adoption in Kenya is one of the tops.

In 2022, Kenya’s Fintech investments reached an all-time high of $158 million and acquired 48 fintech-based deals. Flutterwave Fintech recently announced that Nairobi is East Africa’s tech hub. 97.4% of its startups are tech-based, and Kenyan startups have access to unparalleled ecosystem support for their innovations.

Also, Read Blockchain startups are on course to make Africa a crypto continent.

Almost 240 from the fintech industry have undergone some form of acceleration and incubation. As one of Africa’s fintech hubs, Satatistca Projekte, the total transaction value within all its fintech industries will reach $41.05 million by the end of 2023. Fintech companies such as Mkopa accounted for 47.4% of its fintech investments in 2022. In addition, it raised $75 million in its latest Venture funding round led by Broadscale and Generation Investment Management.

According to o statistics, Kenya’s fintech Industry accounted for 87% of the total deals made annually.

Conclusion

As Africa’s fintech hubs, these three nations have laid down the path for digital transformation for the theatre continent. It’s only a matter of time before Africa’s web3 industry completely assimilates into other sectors. Decentralized finance is merely the first step. After digital money is fully adopted, we might see the integration of blockchain technology into our everyday lives.